Michael Kerr, a director at

EOG Resources (EOG), recently bought 20,000 shares. The buy increased his holdings by 12 percent, and came to a total cost of just under $2.61 million.

The director also logged the last buy at the company in November 2021, with a 50,000 share buy for about $4.3 million. Since then, company insiders have been sellers of shares, mostly after exercising stock options.

Overall, EOG insiders own about 0.5 percent of shares.

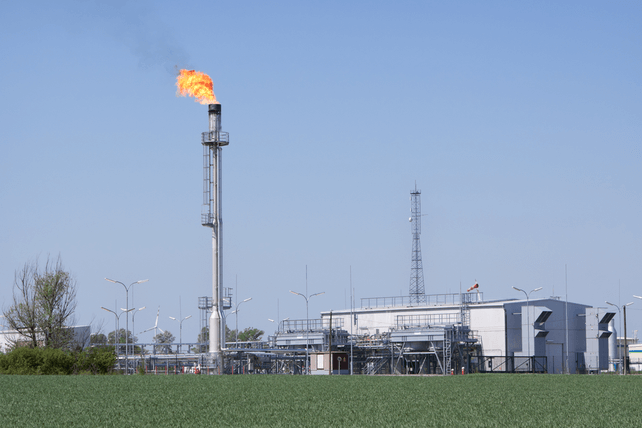

The oil and gas exploration company is up about 24 percent over the past year, thanks to a strong energy market. Earnings have surged 160 percent, and revenues are up 45 percent.

Plus, profit margins have hit 26 percent, a high level for a commodity-related business. Those numbers may slow if energy prices stop trending higher, but will still lead to an above-average operational year for the company.

Action to take: Investors may like shares here, as the stock trades for about 9 times forward earnings.

Shares also yield about 2.5 percent here, with the dividend recently getting a 10 percent annual increase. The company’s low payout ratio could lead to further big dividend hikes in the coming years.

For traders, the July $140 calls, last going for about $9.40, offer a mid-double-digit return from a continued move higher in shares in the coming months.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.