Thomas Whelan, CFO at

Coeur Mining (CDE), recently added 10,000 more shares. The buy increased his holdings by 2.5 percent, and came to a total cost of $42,500.

The buy came two days after the company President and CEO picked up 5,000 shares, at a cost of about $22,000. Over the past three years, insiders have been both buyers and sellers, with buyers having the edge over the past few months.

Overall, insiders own about 1.7 percent of the company.

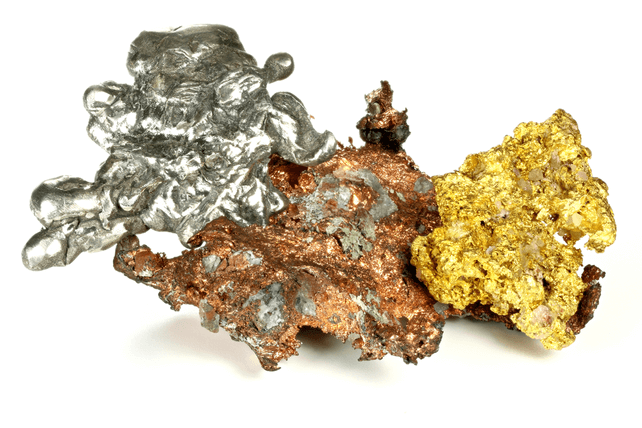

Shares of the gold miner are down about 50 percent in the past year, even as commodity prices have remained near all-time highs. Coeur explores for gold, silver, zinc, and lead, precious metals that have underperformed other commodity prices in the past year.

The company has lost money in the past year as well, with revenue down on lower metals prices and higher energy costs. However, with precious metals starting to move higher, shares could be set to rally higher from here.

Action to take: With gold prices heating up for geopolitical reasons even more so than inflation, it’s likely that shares could move higher from here.

For traders, the September $5 calls have over 6 months to play out. With shares over $4, the options are just out-of-the-money. Last going for about $0.65, a rally in shares could lead to high-double or even low-triple digit returns.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.