Kent Schickli, a director at

Camping World Holdings (CWH), recently added 10,000 shares. The buy increased his holdings by 15 percent, and came to a total purchase price of $284,000.

This marks the first insider buy of the year. Over the past three years, insider buying has been mixed, with large amounts of insider buying in 2019 and 2020, and less insider activity overall in the past year.

Overall, insiders at the company own 4.1 percent of shares.

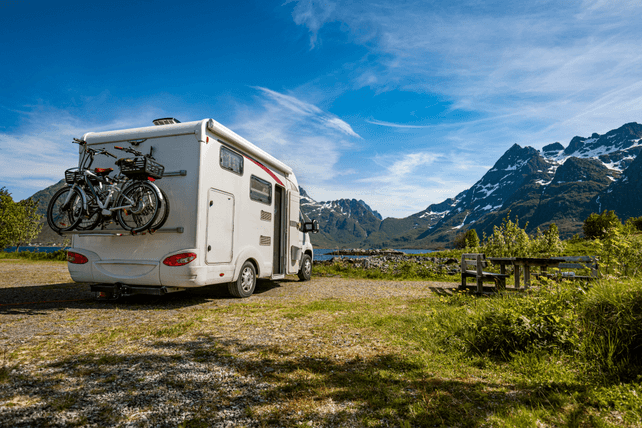

Shares of the recreational vehicle company are down over one-third in the past year. That’s about in-line with the company’s earnings, which slid 28 percent in the past year, even as revenue has risen by nearly 7 percent. However, even with that decline, the company trades at about 5 times earnings.

Action to take: Shares will likely be under pressure until interest rates stop rising, as recreational vehicles tend to be financed. However, given the relative value in shares now, investors should look for the stock to rally strongly when interest rates stop rising. Plus, with the company’s massive dividend, shares yield 9.3 percent right now.

For traders, the September $30 calls, last going for about $2.20, could rally strongly. Traders who wait for a market rebound can likely nab quick high double-digit gains on a surge in shares.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.