David Wichmann, a director at

Boston Scientific Corp (BSX), recently picked up 25,000 shares. The buy increased his stake by 100 percent, and came to a total purchase price of just under $1.05 million.

This action constitutes the sole insider buy of the past three years. Company insiders have largely been sellers, particularly among executives, who are also likely selling off shares acquired as stock options.

Overall, company insiders own 0.2 percent of shares.

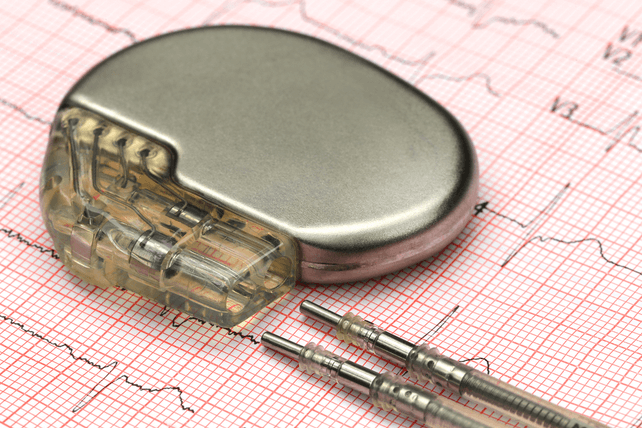

The medical equipment designer and manufacturer has taken a backseat to other companies in the broader healthcare space during and after the pandemic. The stock has lagged the S&P 500 by nearly 10 points in the past year as a result.

Action to take: Shares are fairly valued at 22 times forward earnings, and should continue higher in the years ahead. However, the appreciation should be gradual overall, and the stock pays no dividend at present.

With a low likelihood for a big move higher or lower in shares, traders have a number of options. They can buy shares and sell covered call options to earn extra income, such as the February $42 calls for an extra $1.65. Or traders could sell a put option to potentially acquire shares at a lower price, like the February $40 puts for about $1.60.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.