Vicenzo Vena, CEO of

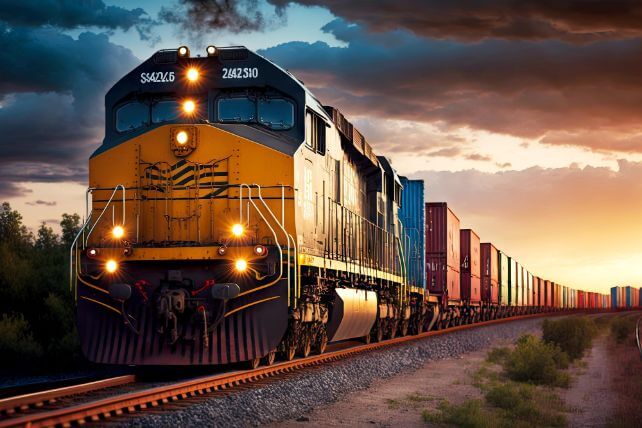

Union Pacific (UNP), recently bought 4,500 shares. The buy increased his position by a massive 742 percent, and came to a total cost of $999,007.

This is the first insider buy at the railroad since October 2022, when a company director bought 1,380 shares, paying just under $260,000. Otherwise, there have been some small insider sales over the past two years.

In total, Union Pacific insiders own 0.2 percent of shares.

The railroad is up 7 percent over the past year, lagging the S&P 500. A slowdown in the sales of goods has weighed on the railroad business.

That’s reflected in a 10 percent drop in UNP’s revenues. Even with that drop, the railroad is profitable, even given the high capital needs of a railroad, and UNP sports 26 percent profit margins.

Shares now trade at 20 times forward earnings, somewhat on the higher end of UNP’s valuation over the past two years.

Action to take: While UNP has struggled operationally, shares are in an uptrend. Today’s buyers can earn a 2.2 percent dividend yield and likely low double-digit gains in the months ahead.

For traders, the uptrend could be leveraged with a trade like the March 2024 $240 calls options. Last going for about $6.95, those options could see mid-double-digit gains on a further rally in the months ahead.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.