James McKelvey, a director at

Emerson Electric (EMR), recently bought 8,000 shares. The buy increased his stake by 234 percent, and came to a total price of $684,000.

He was joined by another director, who bought 500 shares, paying $42,766. And both buys came a day after a third director picked up 3,000 shares, for just under $257,000. This marks the only insider buys over the past two years. Insiders were otherwise small sellers going back to early 2022.

Overall, Emerson Electric insiders own 0.3 percent of shares.

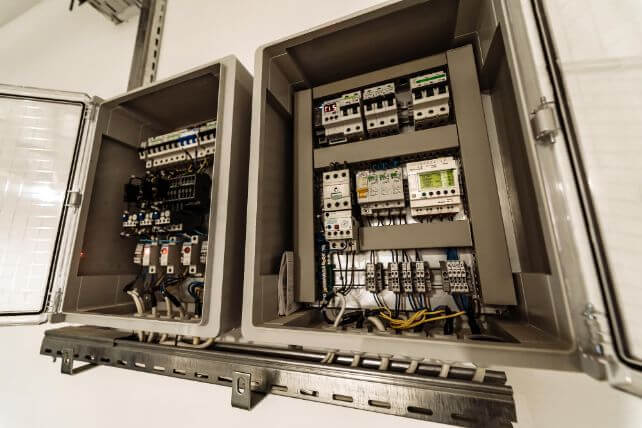

The control systems manufacturer and seller is down 7 percent over the past year, underperforming the overall stock market.

Operations have grown slowly, with earnings up less than 1 percent, and revenues up just 5 percent. That is fairly typical for a large-scale industry-leading company.

However, the company’s systems are crucial for new construction and upgrading and replacing electrical systems. Shares are reasonably priced at under 17 times forward earnings.

Action to take: Investors may like shares, as the company has an excellent long-term uptrend behind it. Shares also pay a 2.3 percent dividend at current prices.

For traders, the January 2024 $90 calls, last going for about $2.00, could see mid-double-digit returns in the coming weeks on a trend higher in shares into the end of the year.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.