Linda Harty, a director at

Chart Industries (GTLS), recently bought 1,000 shares. The buy increased her stake by 14 percent, and came to a total cost of $130,140. The director made a 500 share buy the day before.

Another company director also picked up 400 shares in the same week. Going further back, company executives and directors have been regular and steady buyers of shares, with the last insider sale occurring in September 2021.

In total, Chart Industries insiders own 0.6 percent of shares.

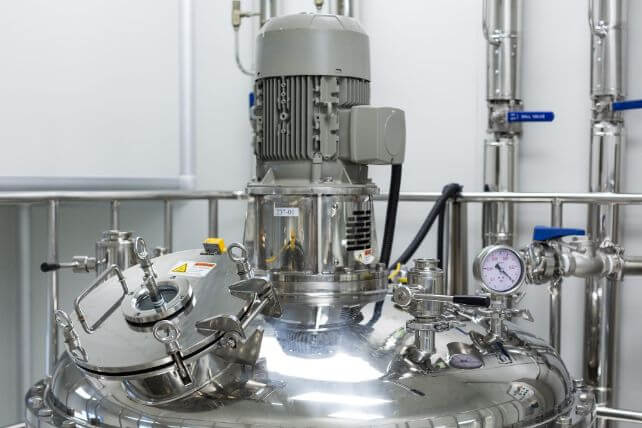

The cryogenic equipment manufacturer is up 15 percent in the past year, slightly lagging the returns on the S&P 500.

Operationally, results have been mixed. Revenues are up 118 percent, but earnings are down about 90 percent.

Shares trade at 10 times forward earnings. However, debt levels are up substantially, and further weakness in operations could weigh on the company.

Action to take: Shares are significantly off their highs, but have started to trend higher in recent weeks. That trend will likely continue in the coming months, for low-double-digit gains. Chart Industries does not currently pay a dividend.

For traders, the current uptrend looks likely to continue in the months ahead. The March 2024 $150 calls, last going for about $6.50, could see mid-double-digit returns on a further rally higher for shares in the coming months.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.