Many professional investors attract followers. And rightly so. Successful fund managers have to report their holdings to the SEC. That means their activity is updated every 90 days.

So it’s easy to follow along someone who’s already shown the capacity to make a market-beating return, no matter what the market condition. And in a bear market, those who follow along can potentially get into a great company at an even better price.

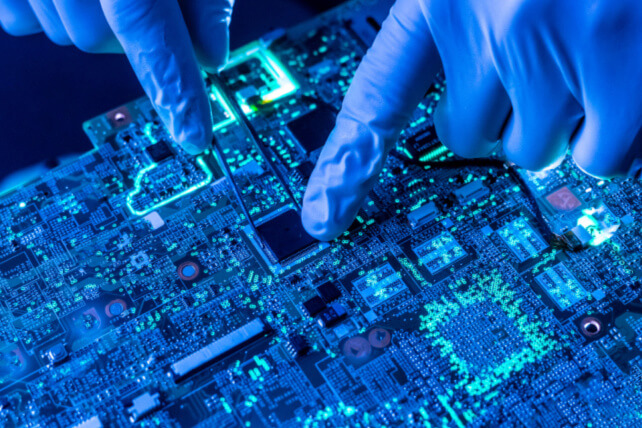

Right now, investors are following an investment in Taiwan Semiconductor (TSM) made by Berkshire Hathaway (BRK-B). While the buyer at Berkshire likely isn’t Warren Buffett, the disclosure of the $4.9 billion stake caused shares of TSM to jump by double-digits.

That still leaves TSM shares down nearly 40 percent over the past year, as investors have moved away from semiconductor stocks. But TSM is a leader in fabrication, and is looking to expand its global operations.

Action to take: Shares of TSM are reasonably valued at 15 times earnings. And shares pay a reasonable 2.5 percent dividend. So long-term investors interested in the stock may want to start adding shares on the next dip in shares in the weeks ahead.

For traders, the Buffett bounce is likely over. But over the longer-term, shares should trend higher. The March 2023 $90 calls, going for about $3.50, offer mid-to-high double-digit return potential in the months ahead. Traders may also want to look to buy on a down day to capitalize on the current market volatility.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.