Earnings season can be a tricky time. A company can report great earnings. But if they warn on guidance, shares may sell off big time. Or, if a company has poor earnings, shares may move higher as things weren’t as bad as the market expected.

In today’s market, most news is likely to lead to a discount in shares, whether good or bad. But that may be creating a solid long-term setup for investors.

One company looking interesting now is

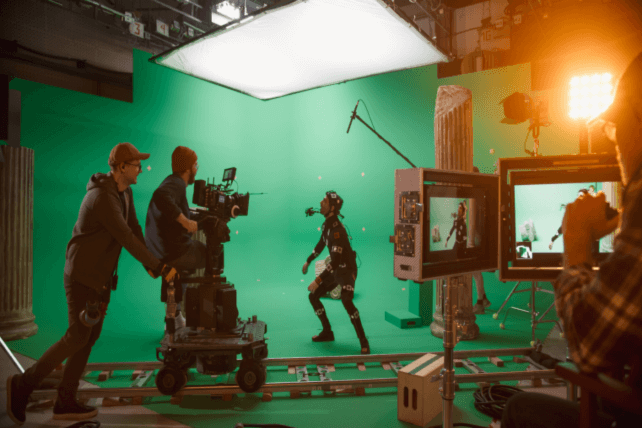

Paramount Global (PARA). Shares are down nearly 50 percent in the past year. But as an oligopoly play in the entertainment space, shares look attractive at 11 times earnings.

Shares slid 12 percent on Wednesday on a slight miss in earnings estimates, even as the company remained profitable and continues to bring in cash for shareholders.

Action to take: Shares look reasonably valued for a big media play at today’s prices. Plus, shares yield about 5 percent at current prices following the latest selloff. As with any long-side investment right now, start small and use dips in shares to add to that position.

For traders, the market seems to have overreacted to earnings. Consider the March 2023 $20 calls, last going for about $0.95. The option can potentially deliver high-double-digit returns before expiration on a rebound in shares.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.