There’s an old Wall Street adage about buying the rumor and selling the news. And traders continue to pile in ahead of a possible development that may or may not pan out. Either way, there tends to be selling later on.

Sometimes the opposite is true as well, with one company’s rumor impacting a competitor and causing their share price to drop.

That may be the case with

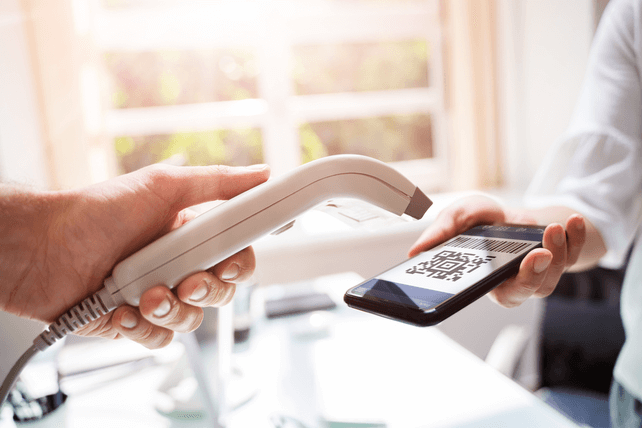

Block (SQ). The payments processing company has been taking a dive for months, but some more salt in the wound came on a rumor that

Apple (AAPL) would turn iPhones into payment terminals without the need for additional hardware.

That rumor didn’t materialize when Apple reported its earnings, but it did push shares of Square further into oversold territory. The stock has now lost two thirds of its peak value in the past year, even with revenues up 27 percent.

Action to take: Shares look attractive here both for the short-term technical oversold levels in tech stocks right now as well as the potential for further growth in the years ahead. The stock is a long way from paying a dividend (if ever), but should reward shareholders from here.

For traders, the May $135 calls, last going for about $5.25, look attractive here. The call premium is still quite high, indicating that the market sees shares as oversold here as well. Traders should look for high double to low-triple-digit gains should shares swiftly rebound in the coming months.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.