The past few months have been great for AI stocks, particularly those working on generative AI software. That’s led to the rise of several prompts that can make work easier, particularly in industries that rely on intellectual capital rather than labor.

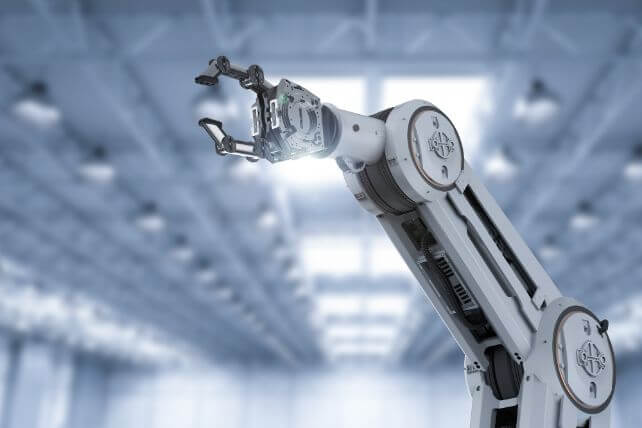

However, the trend will move toward labor too. That’s because AI is a key component for making automation effective. Today, automation largely helps scale up industrial production. That trend could accelerate in the coming years.

One way to play this trend is with Rockwell Automation (ROK). They’re a leader in industrial automation technologies such as robots. And improved AI functionality could improve the tasks that can be completed with automation in the future.

Rockwell shares are already up 60 percent over the past year. But shares aren’t overvalued, going for about 24 times earnings, near that of the stock market as a whole. And there’s likely more upside ahead as they can unveil newer AI-driven automation tools.

Action to take: Long-term investors may like Rockwell shares here, and on any pullback. The company pays a 1.5 percent dividend at current prices. While not large, for an AI-related play, it’s on the larger end.

For traders, shares are likely to continue higher. The October $350 calls, last going for about $8.25, could see mid-double-digit gains in the coming months.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.