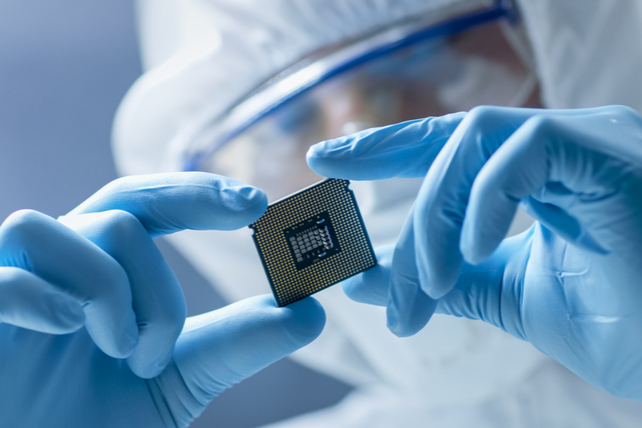

Semiconductors continue to look like a bright spot in the tech space following a drop in a number of tech heavy names so far this year. In particular, companies offering new products now to meet demand for the latest and next-generation tech can likely fare well.

One surprising play?

Intel (INTC). Often written off as a has-been in the chip space thanks to its focus on computers, the company just launched its latest line in server chips, and early results are promising.

Intel has significantly lagged the overall market in the past year, rising about 15 percent, or one-third that of the S&P 500.

Revenues have been flat in that timeframe and earnings have been down, even as the company has made a 27 percent profit margin on its sales. Still, investors would be hard pressed to find a chip company trading at a lower valuation than Intel’s 13 times earnings.

Action to take: Shares look undervalued relative to other big tech chip names here. Investors may like shares, as the company just bumped its dividend to $1.39 from $1.32, for a 2.1 percent yield.

If the latest line of data center chips take off, so could shares in the coming months. The August $70 calls, last trading for about $3.40, could deliver high double-digit returns in a few scant months.

Disclosure: The author owns shares of Intel, but no plans to change the position within the next 72 hours. The author is not receiving compensation for it (other than from Trading Tips). The author has no business relationship with any company whose stock is mentioned in this article.