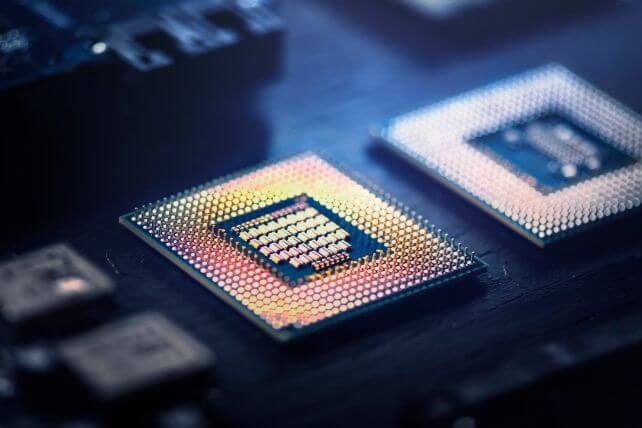

Semiconductor manufacturer

Microchip Technology Incorporated (MCHP) is down 20% over the past year, with shares trending lower since May. One trader sees a rebound in the months ahead.

That’s based on the February 21, 2025 $75 calls. With 78 days until expiration, 10,020 contracts traded compared to a prior open interest of 108, for a 93-fold rise in volume on the trade. The buyer of the calls paid $1.80 to make the bullish bet.

Microchip Technology last traded for just over $65 per share, so the stock would need to rally by about $10, or just over 15%, for the option to move in-the-money.

Microchip shares hit a 52-week low of $62.63 in November and are only slightly off those lows.

The company’s operations have struggled in the past year, with revenues declining a massive 48%. Even with that drop, Microchip still trades at about 23 times earnings, in-line with the overall market.

Action to take: With mixed fundamentals, the stock’s slight momentum higher is the only sign that shares can rally from here. Momentum traders may like the stock, and can earn a 2.6% dividend at current prices.

For traders, the February $75 calls are more attractive to bet on an upside move, since investors can capture such a move with less capital at risk. Microchip may have a catalyst such as its earnings in early February to help push shares higher.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any company mentioned in this article.