There are plenty of big picture tech ideas for investors in the years ahead. With many investors looking for the next big play in electric vehicles, biotech, space tourism, or the like, a number of existing areas in the tech space are attractively priced and capable of bigger growth.

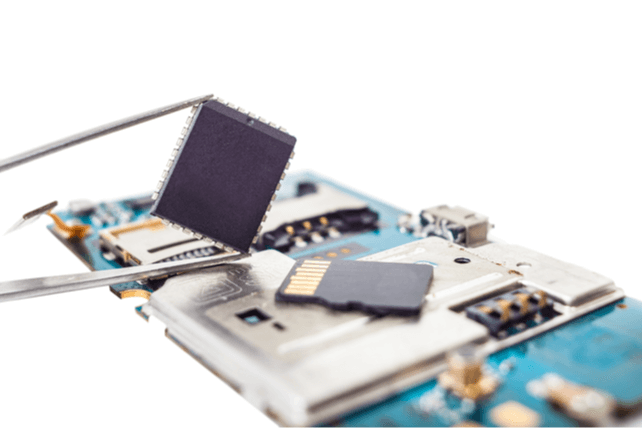

One such area? Smartphones. While 5G is all the rage, the increasing use of smartphones in general is fueling plenty of opportunities for investors to profit from.

Qualcomm (QCOM) showed this trend at work perfectly. The company reported better-than-expected results thanks to strong smartphone demand, with revenue up 43 percent compared to a year ago. This is one chip company that’s firing on all cylinders wight now, including raised guidance for the quarter ahead.

Shares jumped higher on the strong earnings news, but are still trading under 20 times earnings and have underperformed the S&P 500 by nearly 20 points in the past year.

Action to take: The company’s continued strong earnings numbers point to a potential move back to the stock’s old 52-week high near $168. Investors who buy shares now can lock in a dividend near 2 percent with the likelihood of increased payouts in the years ahead.

For traders, the current uptrend is likely to continue. The January $175 calls, last going for about $1.65, stand a decent chance of moving in-the-money in the coming weeks, but could at least deliver high double-digit returns.

Disclosure: The author of this article has a position in the company mentioned here, but does not intend to trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.